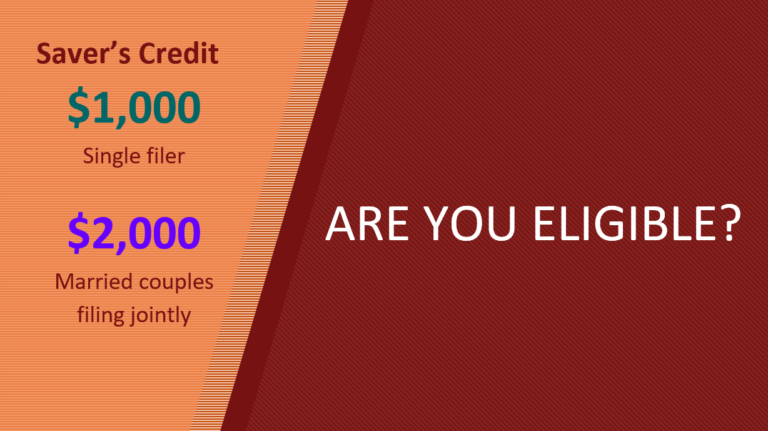

The Saver’s Credit: Are you eligible?

The Saver’s Credit is a tax incentive designed to encourage individuals to contribute to their retirement savings, whether through an Individual Retirement Account (IRA) or an employer-sponsored retirement plan. It’s important to note that this credit is nonrefundable, meaning it can reduce your tax liability but will not result in a refund.