Tax and Accounting Services

About DuPage Tax Solutions

DuPage Tax Solutions is located in Naperville, IL. Our clients are mostly residents and small businesses within the Chicago metropolitan area – DuPage, Cook, Will, and Lake counties. Our remote work capabilities allowed us to extend our services nationwide. Today, we pride ourselves in having clients from all 50 states. Our virtual services are fast, easy, and convenient. Clients submit and review documents electronically through our secured online portal.

Backdoor Roth IRA: What is it?

If you’re looking to maximize your retirement savings but find yourself above the income limits for a Roth IRA, the backdoor Roth IRA might be the solution you need. Let’s break down what a backdoor Roth IRA is, how it works, and why it might be a good option for you.

Home » Backdoor Roth IRA: What is it?

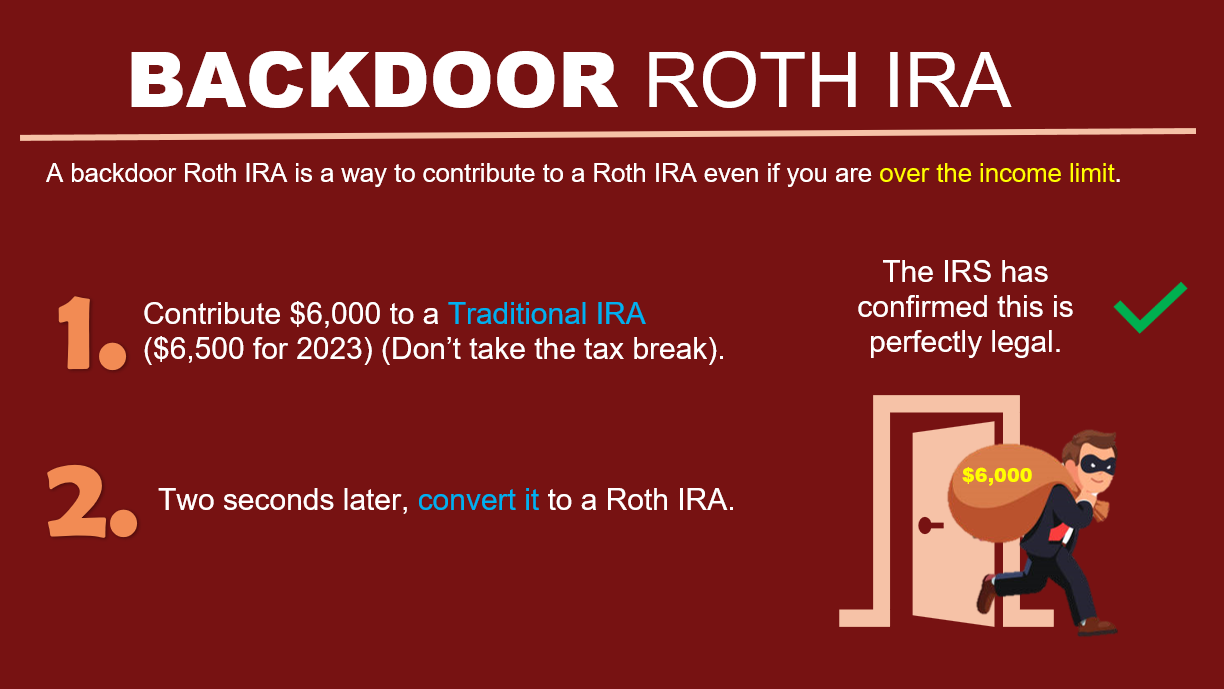

What is a Backdoor Roth IRA?

A backdoor Roth IRA is a way for individuals with income above the IRS Roth income thresholds to fund a Roth IRA. For 2024, the income limit is $161,00 for single filers and $240,000 for married filing jointly filers to make a full contribution.

How does a Backdoor Roth IRA Work?

The backdoor method involves making a contribution to a traditional IRA and then converting those funds to a Roth IRA.

Here are the following steps:

- Open a Traditional IRA: The first step is to open a traditional IRA account if you don’t already have one. This account will be used to make your initial contribution.

- Contribute After-Tax Dollars: You can contribute to your traditional IRA using after-tax money. This means the funds have already been taxed and won’t be taxed again during the conversion.

- Convert to a Roth IRA: After making your contribution, you convert the funds from the traditional IRA to a Roth IRA. This step is crucial, as it effectively allows you to bypass the income limits. However, any earnings are taxable.

Key tax Considerations

Pro-Rata Rule

If your traditional IRA has both pre-tax and after-tax contributions, the IRS applies the pro-rata rule during conversion. This means your taxable amount will be determined by the ratio of pre-tax to after-tax dollars across all your IRAs. For example, if 70% of your total IRA balance is pre-tax money, 70% of any amount you convert will be taxable.

The Five-year rule

Roth IRAs require you to wait five years from the year of your first contribution or conversion to withdraw earnings without penalties and taxes after age 59.5. However, you can withdraw contributions tax-free and penalty-free at any age.

Benefits of a Backdoor Roth IRA

Tax-Free Growth

Once your funds are in a Roth IRA, they grow tax-free, and qualified withdrawals are also tax-free. This can significantly enhance your retirement savings.

No Required Minimum Distributions (RMDs)

Unlike traditional IRAs, Roth IRAs do not require you to take minimum distributions at age 73, allowing your investments to grow longer.

Estate Planning Advantages

Roth IRAs can be passed on to heirs tax-free, making them an excellent tool for estate planning.

is a backdoor roth ira right for you?

A backdoor Roth IRA can be particularly beneficial if you don’t need to access your converted funds for at least five years. However, it may not be suitable if the conversion would lead to a substantial tax bill.

Final Thoughts

The backdoor Roth IRA is an effective strategy for high-income earners looking to enhance their retirement savings. By understanding how it works and the associated rules, you can take advantage of this opportunity for tax-free growth. As always, consider consulting with a financial advisor or tax professional to tailor this approach to your individual financial situation and goals.

You May Also Like These

How Seniors Can Reduce Their Taxes

Retirement Plans for Business Owners

Qualified Charitable Distributions

Ready to Take Control of Your Finances?

Contact us today for personalized tax, accounting, and advisory services tailored to your needs. Let’s work together to achieve your financial goals!

Contact Info

Ph. (630) 909 9700

Email: DPTax@DP-Tax.com

Mail address:

1552 Illinois Rte 59 #1037

Naperville, IL 60564

Business Hours

Mon: 11 am – 7 pm

Tue: 11 am – 7 pm

Wed: 11 am – 7 pm

Thu: 11 am – 7 pm

Fri: 11 am – 7 pm

Sat: 12 pm – 5 pm

Sun: CLOSED

Helpful Links

© 2024 DuPage Tax Solutions | Site Map | Privacy Policy | Disclaimer