Tax and Accounting Services

About DuPage Tax Solutions

DuPage Tax Solutions is located in Naperville, IL. Our clients are mostly residents and small businesses within the Chicago metropolitan area – DuPage, Cook, Will, and Lake counties. Our remote work capabilities allowed us to extend our services nationwide. Today, we pride ourselves in having clients from all 50 states. Our virtual services are fast, easy, and convenient. Clients submit and review documents electronically through our secured online portal.

Real Estate and Stocks: A Comparison

When considering investment options, real estate and stocks are two of the most popular choices. Each offers distinct advantages and risks, and understanding the differences can help you make informed decisions about where to invest your money. In this post, we will explore the key differences between real estate and stocks to help you decide which investment suits your goals and risk tolerance.

Home » Real Estate and Stocks: A Comparison

Stocks Are Riskier Than Investment Properties

Stocks tend to be more volatile compared to real estate, making them a riskier investment. The volatility of stocks can lead to dramatic short-term losses, while property investments typically experience more stability. To mitigate this, tax-advantaged retirement plans like IRAs, 401Ks, and mutual funds offer diversification and professional management of stock investments.

Stocks’ Rate of Return is Typically Higher Than Real Estate

Generally, stocks offer higher rates of return due to their inherent volatility. However, if you have the financial flexibility, using loans to finance real estate investments can also increase your return rate by allowing you to invest less of your own money while gaining exposure to the potential appreciation of property values.

Real Estate Is More Expensive Than Stocks

One of the main barriers to investing in real estate is its higher cost. The median home price in November 2024 was $430,584, with closing costs and down payments adding up to significant sums. By contrast, as of Dec. 2024, the average price of the S&P 500 index was $5,406.54, making stocks more accessible for a wider range of investors.

Real Estate Can Protect Against Inflation

While inflation often erodes the value of stocks, real estate investments tend to rise in value during inflationary periods. Home prices and rental rates typically increase, offering a hedge against inflation. Another way to reap the benefit of inflation protection through real estate is to invest in Real Estate Investment Trusts (REITs). REITs are companies that own income-producing real estate. You can invest in REITs by purchasing individual company stocks or through a mutual fund or exchange-traded fund (ETF). REITs allow you to generate passive income without having to manage or finance property.

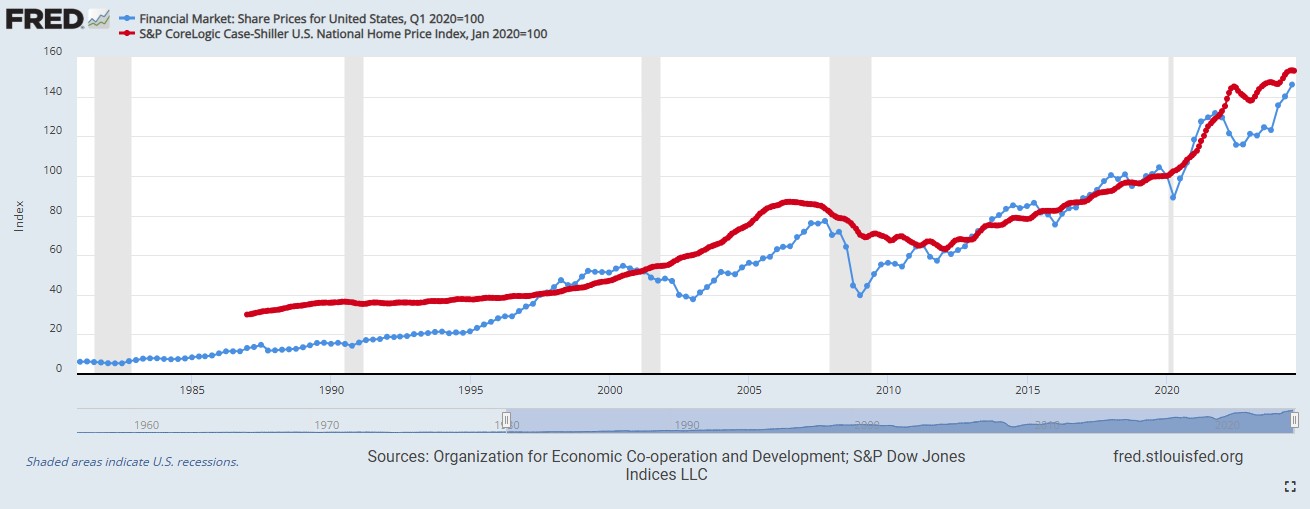

Stocks and Real Estate Perform Differently During Recessions

Real estate tends to be more stable than stocks during recessions, and in some cases, property values even increase. For instance, during the 2008 financial crisis, real estate values declined but less sharply than stocks. In contrast, during the COVID-19 pandemic in 2020, while stocks fell, real estate prices continued to rise.

Source:

Financial market: Share prices for United States | FRED | St. Louis Fed. https://fred.stlouisfed.org/graph/?g=DxQW#

Stocks Are More Liquid Than Investment Properties

Liquidity refers to how quickly an asset can be converted into cash. Stocks are highly liquid; you can sell them on the same day you buy them. Real estate, on the other hand, is far less liquid. On average, it takes 30-60 days days to sell a property. However, investing in REITs can provide more liquidity in real estate investments, offering a middle ground between stocks and traditional property.

Real Estate Offers Tax Advantages

One significant advantage of real estate over stocks is its tax benefits. Real estate investors can defer capital gains taxes through a 1031 exchange, where profits from one property are reinvested into another. Additionally, expenses such as mortgage interest, property taxes, and depreciation can be deducted from taxable income, making real estate a more tax-efficient investment.

What Should I Invest In: Real Estate or Stocks?

Deciding whether to invest in real estate or stocks depends on your financial goals, risk tolerance, and investment strategy. While both options have unique advantages, combining them in a diversified portfolio can help manage risk. Speak with a tax professional, like DuPage Tax Solutions, to understand the tax implications specific to your situation, ensuring that your investment choices align with your long-term financial goals.

You May Also Like These

Should I buy a property now?

Rental Deductions: What are the Rules?

Business Structures for Rental Properties

Ready to Take Control of Your Finances?

Contact us today for personalized tax, accounting, and advisory services tailored to your needs. Let’s work together to achieve your financial goals!

Contact Info

Ph. (630) 909 9700

Email: DPTax@DP-Tax.com

Mail address:

1552 Illinois Rte 59 #1037

Naperville, IL 60564

Business Hours

Mon: 11 am – 7 pm

Tue: 11 am – 7 pm

Wed: 11 am – 7 pm

Thu: 11 am – 7 pm

Fri: 11 am – 7 pm

Sat: 12 pm – 5 pm

Sun: CLOSED

Helpful Links

© 2024 DuPage Tax Solutions | Site Map | Privacy Policy | Disclaimer