Tax and Accounting Services

About DuPage Tax Solutions

DuPage Tax Solutions is located in Naperville, IL. Our clients are mostly residents and small businesses within the Chicago metropolitan area – DuPage, Cook, Will, and Lake counties. Our remote work capabilities allowed us to extend our services nationwide. Today, we pride ourselves in having clients from all 50 states. Our virtual services are fast, easy, and convenient. Clients submit and review documents electronically through our secured online portal.

How to Find a Tax Accountant in DuPage County

Finding a tax accountant in DuPage County is an important decision, but with the convenience of online services, you can access top-tier tax expertise no matter where you are. Whether you’re an individual or a business owner, our remote tax accounting services allow you to work with a knowledgeable, experienced accountant without needing to leave your home or office. Here’s everything you need to know to find the right online tax accountant for your needs.

Home » Online Tax Resources » How to Find a Tax Accountant in DuPage County

Why Hire an Online Tax Accountant in DuPage County?

A tax accountant in DuPage County has specific knowledge about Illinois tax laws and can help you navigate the intricacies of local and state taxes. Therefore, whether you’re filing as an individual or for your business, a local accountant can offer the following benefits:

Local Expertise for DuPage County Tax Needs

Due to their familiarity with DuPage County-specific tax rules, a local accountant can ensure compliance and accuracy.

Personalized Service

In addition, access professional tax services tailored to your specific needs, from tax preparation to ongoing planning and advice, all through secure online platforms.

Convenience

Even better, work with an experienced tax accountant in DuPage County without the need for in-person meetings. Schedule consultations and submit documents remotely from the comfort of your home or office.

With DuPage Tax Solutions, you get professional services from a team that’s both local and entirely online—ensuring you receive the personal service you deserve while taking advantage of the flexibility of the internet.

Key Steps to Finding the Right Tax Accountant in DuPage County

To find the right tax accountant in DuPage County, especially for online services, follow these simple steps:

1. Determine Your Tax and Accounting Needs

First, identify what kind of tax help you need. Whether you require individual tax preparation, small business tax planning, or ongoing consulting, knowing your needs will help you choose the right online tax accountant. For example, if you’re a business owner, look for an accountant who specializes in business taxes and is familiar with the unique financial challenges businesses face.

2. Verify Qualifications of Your DuPage County Tax Professional

Next, ensure that the online accountant is qualified to handle your tax situation. Look for certifications such as Certified Public Accountant (CPA) or Enrolled Agent (EA), as well as experience in both local (DuPage County) and federal tax laws. Verify whether they have experience with remote services and secure document sharing platforms, as this ensures smooth communication and trust.

3. Read Reviews for DuPage County CPA's and EA's

Furthermore, reviews and testimonials from past clients can give you insight into the accountant’s reliability and the quality of their services. Specifically, look for testimonials from other clients who have used online tax services and benefited from the experience. With DuPage Tax Solutions, you can find numerous testimonials highlighting our seamless remote services and personalized attention.

4. Schedule an Initial Consultation (Online!)

Additionally, once you’ve shortlisted potential accountants, schedule an initial online consultation. This gives you the opportunity to assess how well the accountant communicates and if they understand your needs. During this consultation, ask about their process for handling remote work, the technology they use for secure document exchange, and how they charge for their services.

5. Review Their Pricing and Services

Finally, make sure to review their pricing structure. Online services often come with more flexible pricing than traditional in-person consultations. Ensure that their fees align with your budget and that you understand what services are included in the cost.

How DuPage Tax Solutions Can Help with Your Tax and Accounting Needs

At DuPage Tax Solutions, we specialize in providing top-tier online tax services to individuals and businesses across DuPage County and beyond. Here’s how we stand out:

To start, we believe in transparent pricing with no hidden fees. Our upfront, clear pricing ensures that you know exactly what to expect, so there are no surprises when it comes to your bill. We offer competitive rates based on the complexity of your tax situation and the level of service required.

Moreover, we never compromise on personalization. Our online tax accountants work closely with you to understand your financial goals and create solutions tailored to your needs. Whether you need tax preparation or ongoing financial advice, we are here to help—remotely, when and where you need us.

Additionally, at DuPage Tax Solutions, we put our clients first. Our team is dedicated to providing exceptional customer service, always available to answer questions and guide you through the tax process. We understand that taxes can be stressful, and we’re here to make it as easy and stress-free as possible.

Discover how we can support you through every step of the tax process.

At DuPage Tax Solutions, our team specializes in working with various industries, from healthcare professionals to small businesses and everything in between. Our deep knowledge of industry-specific tax codes ensures that you receive the most relevant and accurate advice, helping you maximize tax efficiency while staying compliant. With our online services, you can access expert guidance no matter where you are, making it easy to manage your industry-specific tax needs.

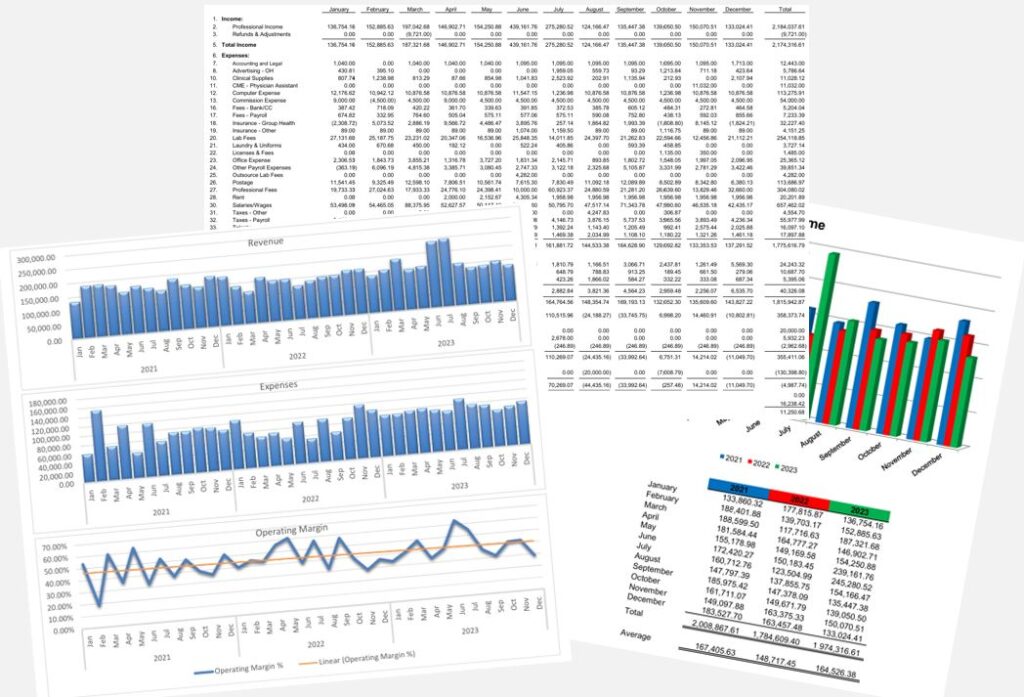

Moreover, we offer exclusive reporting designed specifically for business owners, featuring financial trend analysis and clear, accessible accounting data. This comprehensive reporting provides an easy-to-understand overview of your business’s performance, including insights into cash flow, profitability, and key financial trends. With this level of clarity, you’re empowered to make well-informed decisions that drive growth and improve your bottom line.

With over 30 years of experience in tax and accounting, DuPage Tax Solutions is led by a Harvard-educated professional who brings a wealth of knowledge and expertise to the firm. This extensive experience, combined with an advanced education from one of the world’s leading institutions, ensures that our clients receive the highest level of service and the best possible outcomes. Our online platform allows you to access that expertise from anywhere, at your convenience.

Learn more about our firm’s history and commitment to excellence.

Common Questions About Hiring a Tax Accountant in DuPage County

How do online tax services work?

At DuPage Tax Solutions, our online tax services are designed to be simple and secure. You’ll upload your documents via our secure portal, schedule virtual meetings with your accountant, and receive your completed tax returns electronically—all without leaving your home.

What’s the difference between a CPA and an EA?

A Certified Public Accountant (CPA) is licensed by the state and can offer a wide range of tax and accounting services, while an Enrolled Agent (EA) is licensed by the IRS to represent taxpayers in tax matters.

How can I know if I need a tax accountant?

If your tax situation is complex—such as owning a business, having multiple income sources, or dealing with investments—a tax accountant can help ensure that you’re compliant and maximize deductions.

How far in advance should I hire a tax accountant?

It’s best to start looking for a tax accountant at least a few months before the tax filing deadline to ensure ample time for accurate filing and planning. For businesses, establishing a year-round relationship is beneficial for ongoing advice and tax planning.

Ready to Take Control of Your Finances?

Contact us today for personalized tax, accounting, and advisory services tailored to your needs. Let’s work together to achieve your financial goals!

Contact Info

Ph. (630) 909 9700

Email: DPTax@DP-Tax.com

Mail address:

1552 Illinois Rte 59 #1037

Naperville, IL 60564

Business Hours

Mon: 11 am – 7 pm

Tue: 11 am – 7 pm

Wed: 11 am – 7 pm

Thu: 11 am – 7 pm

Fri: 11 am – 7 pm

Sat: 12 pm – 5 pm

Sun: CLOSED

Helpful Links

© 2024 DuPage Tax Solutions | Site Map | Privacy Policy | Disclaimer